Here's why nib is a great choice for you

Your health, your choice

You’ll have more choice about your care. You can also find healthcare providers near you using our Find a Provider directory.

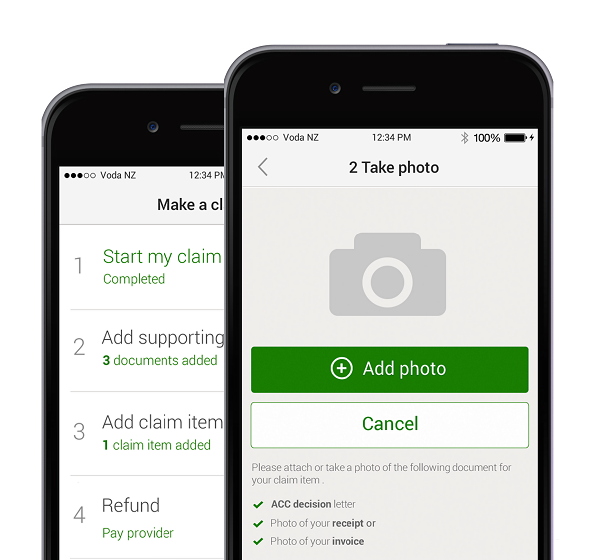

Easy to use and easy to claim

Manage your health insurance cover wherever you are with my nib and the nib app, whether it’s making a claim or contacting us to make a change to your cover.

Support and tools to better manage your health

Eligible members can improve their health through our Health Management Programmes for conditions like joint pain, heart health, or cancer treatment*.

*View how to register and the eligibility criteria of the programmes.

Who can you see for treatment?

You can search our directory to find healthcare providers in your area. Find out if your healthcare provider is part of our First Choice network and whether they can take care of your paperwork, so you can focus on getting well.

Health and Wellbeing

17 Jul 2024

From silly to wise, these are some of the most commonly asked questions about wisdom teeth removal.

05 Jun 2024

Did you know that prostate cancer is the second most commonly diagnosed cancer in New Zealand affecting roughly 4,000 men a year? In fact, more than 700 men die of prostate cancer each year, making it the second leading cause of cancer death in men after lung cancer.

30 May 2024

Today, nine New Zealand women, on average, will receive news that they have breast cancer. It’s the most common cancer for Kiwi women. Here's what you need to know about breast cancer checks and what to do if you feel a possible breast cancer lump.