Health Insurance

How health insurance works

Private health insurance helps protect you from the unexpected. It’s an alternative to public, government funded healthcare and may offer a broader range of treatment options.

Depending on the cover you choose, health insurance can help cover you for the big things like seeing a specialist, surgery or cancer treatment, as well as everyday health needs like the dentist, GP and physio. You can buy private health insurance directly from a health insurer like nib, through an independent financial advice provider, or it may be available through your employer.

Why health insurance is worth it

The public health system in New Zealand offers free or low cost treatment at public hospitals for Kiwis, but high demand and the rising cost of providing healthcare creates challenges.

- If you need non-urgent treatment, you might be put on a waiting list which can lead to stress and uncertainty. How long you wait may depend on the severity of your condition.

- If your condition is not accident-related, treatment costs won’t be covered by ACC (the Accident Compensation Corporation).

- You may have less control over when and where you are treated.

- You have to pay the costs of drugs that aren’t funded by PHARMAC (including any drug administration costs).

That’s where private health insurance comes in.

- You have the choice of private treatment and surgery without relying on the public health system.

- You can choose who you see and when you are treated.

- Faster treatment means you can get back on your feet quicker, whether that be for work or play.

- You have peace of mind as your health insurer will cover approved costs for expensive private treatments and surgeries.

- You can choose to add extra cover for non-PHARMAC funded drugs.

What will it cost me if I’m uninsured?

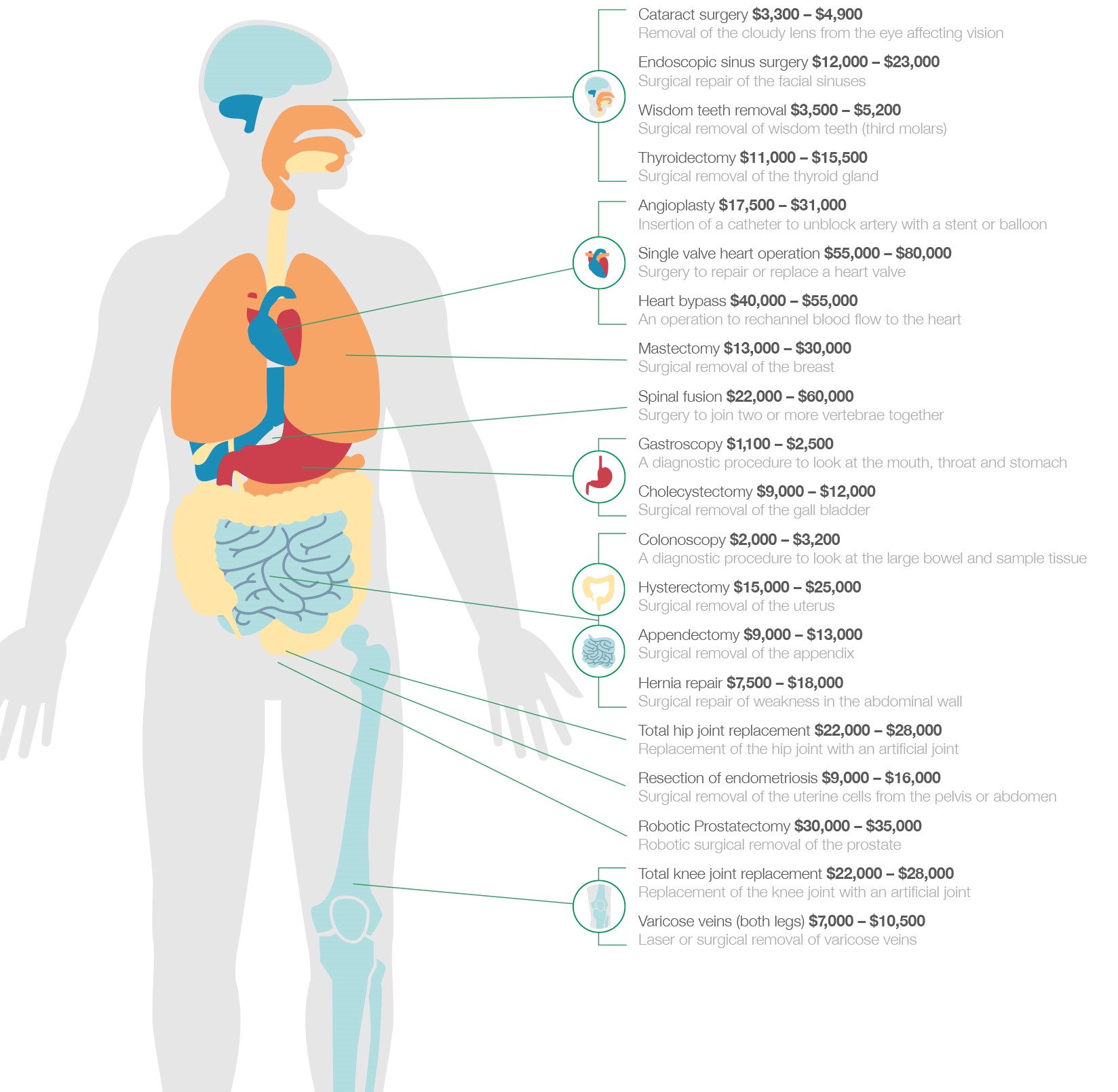

Health insurance helps cover the costs of private treatment, as well as giving you more control over who treats you and when. Without it, private treatment could be unaffordable or make a significant impact on your hard-earned savings and lifestyle.

Take a look at what some common private treatments could cost in New Zealand if you choose to pay for them yourself, without health insurance1.

View more common surgery costs below

1 nib average claim statistics for Everyday and GP minor surgery claims during 2020 and for Outpatient and Hospital claims from October 2020 to February 2021. This is an illustration of treatments and costs you could expect to pay if treated without health insurance contribution for Everyday healthcare or in private hospital for Outpatient and Hospital healthcare. This is not a representation of conditions covered on your policy or the amount that would be paid by nib in the event of a claim.

2 nib claim statistics for October 2020 to February 2021. This is an illustration of treatments and costs you could expect to pay if treated without health insurance contribution in private hospital. This is not a representation of conditions covered on your policy or the amount that would be paid by nib in the event of a claim.

Find the right cover for your needs

It's important to make sure your health insurance matches your needs and lifestyle. There are two main types of cover:

- Everyday: cover for day-to-day healthcare needs like dentist, GP or physio visits.

- Hospital: cover for the big things like surgery or cancer treatment, outpatient health costs like seeing a specialist or surgeon, and diagnostic investigations.

As well as what type of cover, you’ll need to consider who you’d like cover for - whether that’s just yourself, your partner or family.

You also have some flexibility to pick an excess level if you choose a plan with Hospital cover. Your excess level will affect the amount you pay in premiums – a higher excess means a lower premium.

Take a closer look at our plans and get a quote online or, if you’d like to discuss your options, call us on 0800 123 642.

Here's why nib health insurance is a great choice for you

Your health is our focus

We specialise in health insurance and, as part of nib Group, we protect the health of over 1.4 million Kiwis and Aussies every day.

One-on-one support

nib's dedicated Wellness Coaches can work with you to provide support through your health journey.

Our members come first

We help our members navigate their health and wellbeing journey.

nib members

Angelina’s story:

“It’s wonderful…huge peace of mind.” After losing her sister to a brain tumour, health insurance has given Angelina the confidence that she can access the care she needs, when she needs it.