Here's why nib is a great choice for you

Your health, your choice

You’ll have more choice about your care. You can also find healthcare providers near you using our Find a Provider directory.

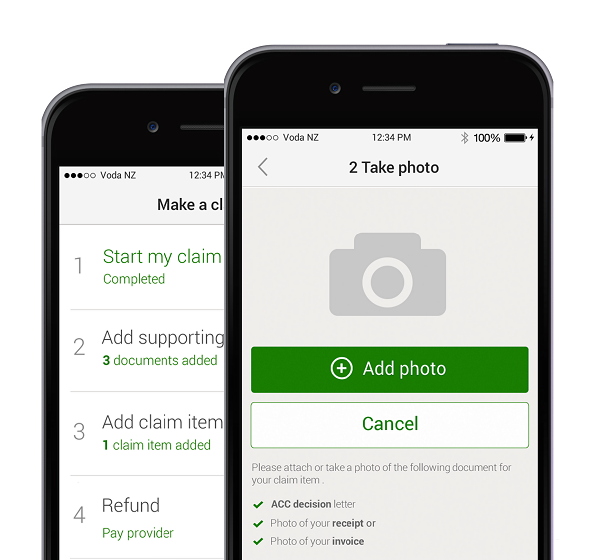

Easy to use and easy to claim

Manage your health cover wherever you are with my nib and the nib app, whether it’s making a claim or contacting us to make a change to your cover.

Support and tools to better manage your health

Eligible members can improve their health through our Health Management Programmes for conditions like joint pain, heart health, or cancer treatment*.

*View how to register and the eligibility criteria of the programmes.

Who can you see for treatment?

You can search our directory to find healthcare providers in your area. Find out if your healthcare provider is part of our First Choice network and whether they can take care of your paperwork, so you can focus on getting well.

Health and Wellbeing

16 Apr 2024

If you’re worried about your health history, we’re here to help. Find out how nib handles pre-existing conditions now.

16 Apr 2024

If you’ve been dealing with some aches and pains - whether that’s a sore back caused by working from home or a pulled hamstring after exercising - it may be time for you to see a health professional to get it sorted. But when you’ve got different recommendations thrown your way, how do you know which option is best to help manage your condition?

16 Apr 2024

In New Zealand, basic dental care is available free-of-charge for eligible children up to the age of 18. This helps set the stage for positive habits into adulthood, encouraging people to take a proactive approach to oral health by driving home the importance of looking after your teeth. Unfortunately, the cost of dental treatment for adults in New Zealand can be prohibitive for a lot of people, and many Kiwis opt to put up with bad (and painful) teeth rather than pay to visit a dentist.